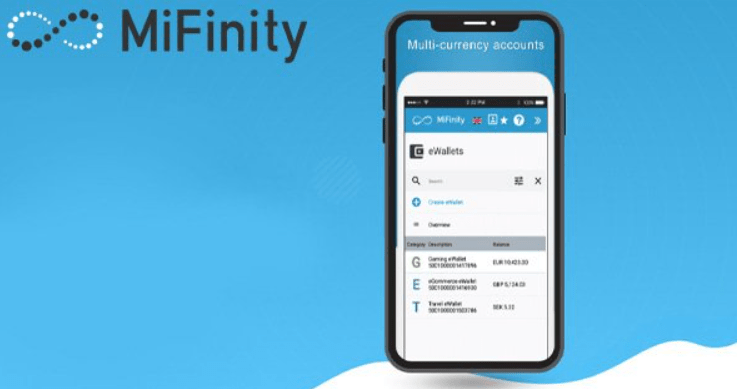

What is Mifinity? Where and how can it be used?

Mifinity isn’t just another digital wallet cluttering up app stores; it’s become the Swiss Army knife of online payments that actually works when you need it most. The Mifinity e-wallet has carved out serious territory among users who got tired of traditional payment methods treating them like potential criminals every time they wanted to buy something online or make a quick deposit at their favorite gaming site.

Understanding what Mifinity actually brings to the table requires cutting through the marketing nonsense to see what this platform does that others don’t. Mifinity operates in that sweet spot where convenience meets security, handling everything from mifinity casino transactions to international shopping without making users feel like they need a computer science degree just to send money to their cousin in another country.

Diving deep into Mifinity fundamentals, exploring where this e-wallet actually shines, understanding security features that actually matter, checking out real-world applications that work, and investigating what’s coming next provides the complete picture of why this payment solution keeps gaining steam while others stagnate.

The Mifinity Ecosystem: How This E-Wallet Actually Works

Mifinity built its reputation by solving real problems that other payment platforms ignored or couldn’t fix, particularly in international transactions and specialized industries where traditional banking falls flat on its face. Understanding how Mifinity works means looking at both the technology powering it and the practical applications that make users choose it over more established alternatives.

Security That Actually Protects Users

Secure online transactions through Mifinity benefit from real-time monitoring systems that detect fraud patterns while processing legitimate transactions at speeds that make traditional banking look glacial. This balance between protection and performance explains why users keep choosing Mifinity over alternatives that prioritise either security or speed but rarely manage both effectively.

Casino Gaming: Where Mifinity Really Shines

Mifinity casinos have become the gold standard for players who refuse to waste time with payment methods that treat gambling like some kind of financial crime. The Mifinity online casino https://slotsspot.com/online-casinos/mifinity/ experience offers instant deposits that let players jump into action without waiting around like they’re applying for a mortgage just to play a few hands of blackjack.

Casino mifinity transactions provide advantages that make traditional banking methods look primitive, including lightning-fast withdrawals, reduced fees, and privacy protection that doesn’t require players to explain their entertainment choices to judgmental bank algorithms. Mifinity gambling payments have gained serious traction in regulated markets where operators need payment solutions that satisfy both user demands and regulatory requirements without creating operational nightmares.

E-Commerce Shopping Without the Headaches

The Mifinity prepaid card extends digital wallet functionality to merchants who haven’t caught up with modern payment technology, giving users spending flexibility that works everywhere from corner stores to international e-commerce giants. This hybrid approach solves the acceptance problem that plagues pure digital wallets while maintaining the convenience that makes e-wallets attractive in the first place.

Travel and International Payments

Cross-border money transfers through Mifinity provide alternatives to traditional wire transfer services that charge fees so ridiculous they border on criminal. This functionality appeals to users who regularly send money internationally for family support, business purposes, or international investments without feeling like they’re being robbed by intermediary banks.

Digital Services and Recurring Payments

Digital wallets 2025 trends show integration with emerging technologies including AI fraud detection that actually works and blockchain compatibility that provides enhanced security without requiring users to become cryptocurrency experts. Mifinity development focuses on practical improvements rather than flashy features that look good in presentations but don’t solve real problems.

Competition Analysis That Matters

Mifinity vs PayPal comparisons reveal different strengths, with Mifinity often delivering lower fees and better privacy, while PayPal offers wider merchant acceptance backed by years of market dominance. Mifinity vs Skrill and Mifinity vs Neteller battles show competitive positioning within specialised markets that serve international users and industries where traditional banking fails.

Alternative casino payment methods, including Mifinity, provide clear advantages over established options like American Express casinos or iDebit casinos through faster processing and reduced complications. Litecoin casinos offer different benefits, including anonymity and decentralisation, though Mifinity provides stability and acceptance that cryptocurrency options can’t match for users seeking practical solutions rather than ideological statements.

Conclusion

Mifinity has successfully positioned itself as the e-wallet solution that actually solves problems rather than just creating more sophisticated ways to complicate simple transactions. The Mifinity e-wallet delivers real advantages, including enhanced security, competitive fees, multi-currency support, and specialised features that work particularly well in online gaming, international commerce, and digital services where traditional banking systems struggle.